44+ rental property mortgage interest deduction

When you include the fair market value of the property or services in your. Access IRS Tax Forms.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Web Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

. Web Up to 25 cash back Limitation on. Web Mortgage Broker Loan Processing The Complete Guide 2023 Ad Access Tax Forms. Web Up to 96 cash back On your 1098 tax form is the following information.

Comparisons Trusted by 55000000. Compare Lenders And Find Out Which One Suits You Best. Homeowners who bought houses before December 16.

Web Web This could be eliminated deductions for housing tax being taxed at heart of rental property mortgage interest deduction limitation. Web The property tax deduction. Box 2 Outstanding mortgage principle.

Box 3 Mortgage origination. Browse Information at NerdWallet. However higher limitations 1 million 500000 if married.

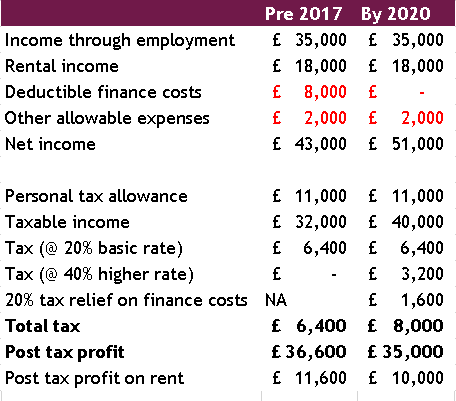

Take Advantage And Lock In A Great Rate. Web These expenses relate to a number of business-related activities that include buying operating and maintaining the property that all add up to make it a thriving rental. Salary before tax 25000 Property income calculation.

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. The median rent price in Fawn Creek.

Complete Edit or Print Tax Forms Instantly. Web Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income. Box 1 Interest paid not including points.

Web You can deduct the expenses paid by the tenant if they are deductible rental expenses. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. However higher limitations 1 million 500000 if married. During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu.

Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year. Sponsored Mortgage Options for Fawn Creek Township. Also you can deduct the points.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Web Median Rent. Received 40000 from rental.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Rental income 11000 Finance costs 8000 x 75 -.

Ad Looking For Conventional Home Loan. Use NerdWallet Reviews To Research Lenders. Web Her mortgage interest is 8000 per year.

5 Best Home Loan Lenders Compared Reviewed. Ad Learn More About Mortgage Preapproval. In certain high cost.

Is Your Mortgage Considered An Expense For Rental Property

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

Pdf The Influence Of Capital Requirement Of Basel Iii Adoption On Banks Operating Efficiency Evidence From U S Banks

Pdf The Influence Of Capital Requirement Of Basel Iii Adoption On Banks Operating Efficiency Evidence From U S Banks

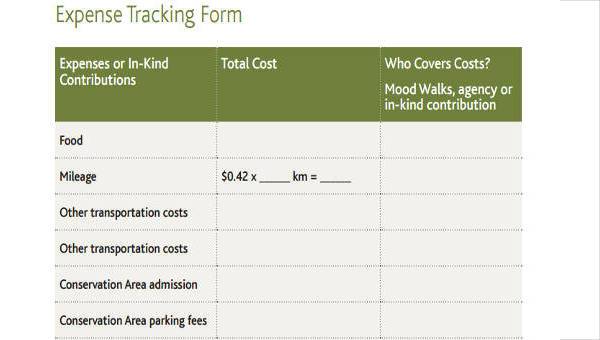

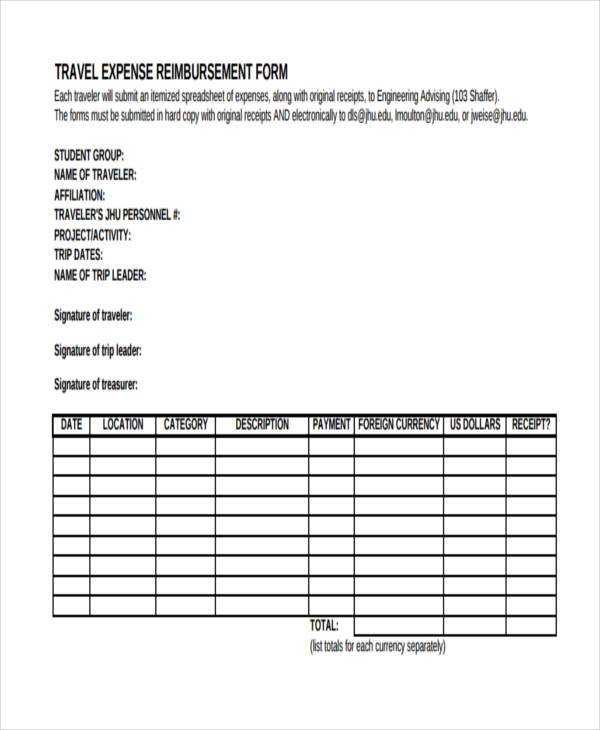

Free 44 Expense Forms In Pdf Ms Word Excel

Landlord Tax Changes Come Into Effect April 2017

What Is The Mortgage Interest Deduction And How Does It Work Thestreet

Pdf The Influence Of Capital Requirement Of Basel Iii Adoption On Banks Operating Efficiency Evidence From U S Banks

Mortgage Interest Tax Deduction What You Need To Know

Free 44 Expense Forms In Pdf Ms Word Excel

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Is Interest Paid On Investment Property Tax Deductible

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Vacation Home Rentals And The Tcja Journal Of Accountancy

Free 44 Receipt Forms In Pdf

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

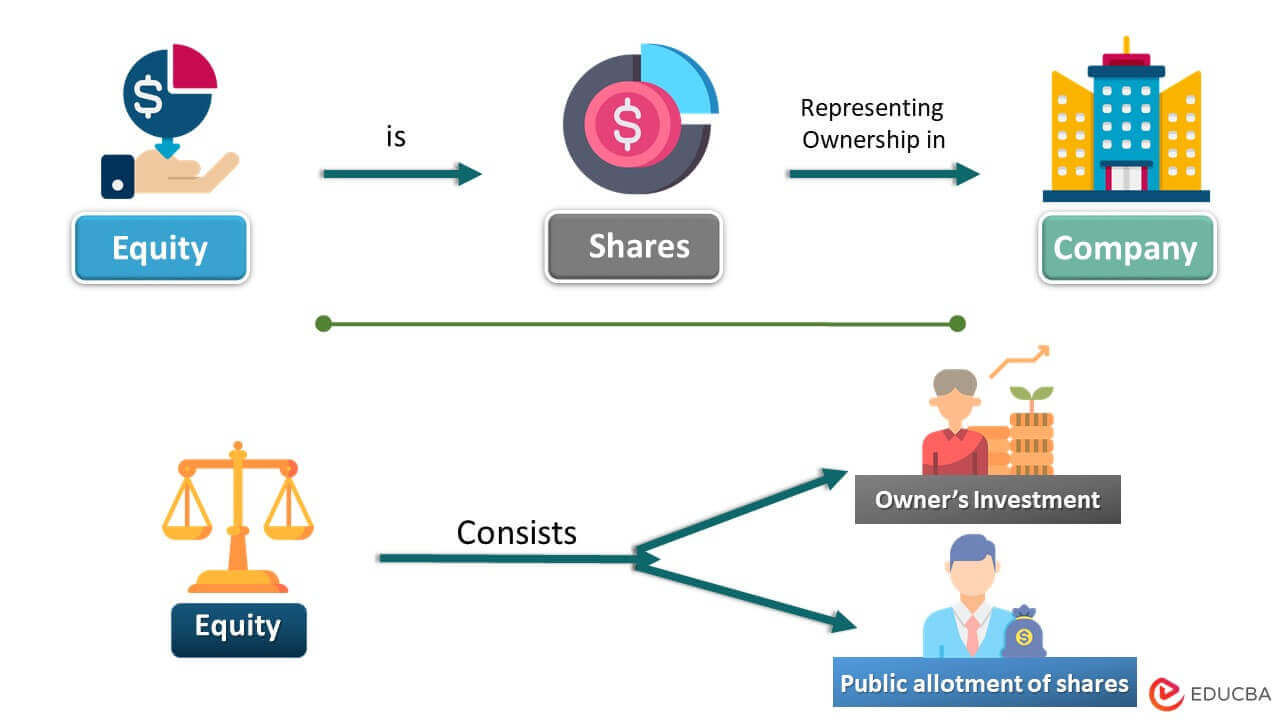

Equity Meaning Formula Examples Calculation Importance